CFDs - Contract for Differences

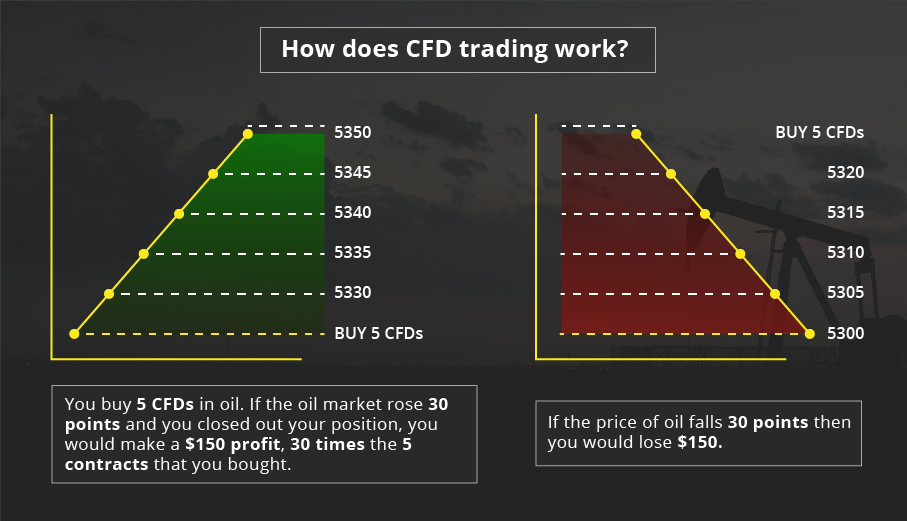

When you buy or sell a contract for difference (CFD) you are agreeing to exchange the difference in

price of an asset from the point at which your position is opened to when it is closed.

CFDs enable your investment capital to go further, as you only have to deposit a fraction of your

trade’s full value to open a position. The deposit you’ll have to put down is called margin.

Because a CFD trade consists of an agreement to exchange the difference between the opening and closing

price of your position, it is more flexible than other forms of trading. This allows you to trade on

markets that are heading down as well as up.

When you trade CFDs on a dealing platform, you’ll see two prices listed: the buy price and the sell

price. You trade at the buy price if you think that the market is going to go up in price, and the sell

price if you think it is going to go down in price.